|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Reliance Mortgage Company and Its OfferingsReliance Mortgage Company is a leading provider in the mortgage industry, known for offering a variety of home loan options to suit different needs. This article explores the services provided by Reliance Mortgage Company, how they compare to other good home loans providers, and what you can expect when choosing them as your mortgage partner. Types of Loans Offered by Reliance Mortgage CompanyReliance Mortgage Company offers a range of mortgage products tailored to meet the diverse needs of its clients. Below are some of the main types:

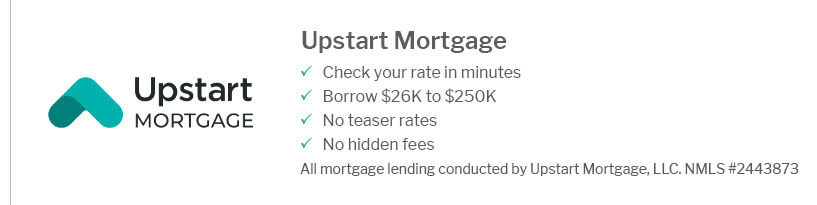

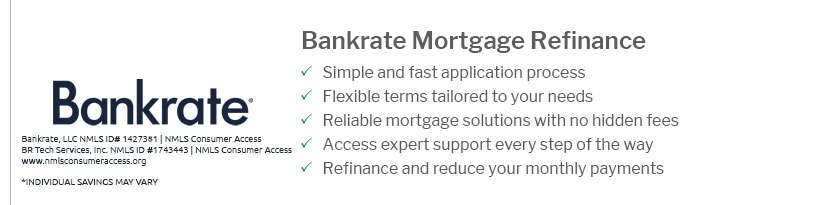

Comparing Reliance Mortgage Company with Other OptionsWhen considering your mortgage options, it's important to compare what Reliance Mortgage Company offers with other mortgage lenders in ct and beyond. Interest Rates and TermsReliance Mortgage Company is known for competitive interest rates and flexible terms. They often provide personalized solutions to fit individual financial situations. Customer ServiceThey pride themselves on excellent customer service, offering support throughout the loan process to ensure a smooth experience. Application Process

Understanding the application process is crucial for a successful mortgage experience. Frequently Asked Questions

https://www.reliancemortgage.com/

We are a 25-year old Dallas based mortgage company that relieves Texas home buyers of the stressful process of finding, applying for and qualifying for a loan. https://www.reliancefirst.com/

Reliance First Capital provides home loan programs, refinancing options, and custom mortgage lender services for first time and existing homeowners. https://www.reliancemortgageloans.com/

The RELIANCE HOME mobile app guides you through your home search and mortgage financing and connects you directly to your loan officer and REALTOR.

|

|---|